Michael Burry Is Probably Wrong About Timing - But Right About What Comes Next

When markets grind higher and volatility collapses, most investors start to believe risk has gone away. They measure portfolios by how much short-term pain they have avoided, not by how well they will compound over the next decade. That is exactly the moment when serious risk accumulates quietly and pain shows up later. I’ve heard the phrase ‘buy the dip’ way too often recently.

That is where Michael Burry’s commentary fits in this environment. People fixate on his timing, as if predicting when prices will go down is the main skill. It is not. Timing is almost always unknowable. Markets stay irrational longer than anyone expects. Liquidity can overwhelm logic for years. But the setup he is talking about has merit because it is structural, not emotional.

When markets rise, most investors stop underwriting risk. They assume rising prices equal safety. That assumption makes the wrong things more expensive and the right things cheaper by default. Rising markets do not make businesses healthier; they make them appear healthier.

You can beat earnings expectations and still destroy value, and you can generate top-line growth and fail to create shareholder returns. Running a good P&L does not mean deploying capital well. Capital allocation becomes obvious in hindsight. That pattern has not changed, even if price charts look tidy.

Markets reward decisions, not stories. Currently, mechanical forces are driving prices more than business improvements. Passive flows, index rebalancing, and mandate-driven buying allow markets to rise without corresponding improvements in return on invested capital. That disconnect hides structural risk. Investors who focus on timing market peaks and troughs often miss the real source of future returns. Big moves in stock prices usually follow changes in capital allocation, not earnings beats. When management reassigns capital away from low-return uses into higher-return uses, that is where future returns begin. You can see earnings dictated by accounting changes. You cannot see capital discipline until it hits cash flows and balance sheets.

Part of what Burry is talking about is not valuation. It is capital inefficiency. Investors are wasting too much capital on low-return projects, dividend maintenance, acquisitions without return discipline, and buybacks executed at inflated prices. Rising markets tolerate these behaviors because the price disguises them. When liquidity tightens, those behaviors become obvious and painful. We are not there yet in price, but the structural tensions are already visible in cash deployment decisions. Markets do not break because earnings are bad. They break when capital is misallocated and liquidity is no longer there to mask it. The real risk today is that earnings are strong. The real risk is that capital allocation mistakes have become embedded in corporate strategy and will be revealed when conditions shift. This is why the ‘what next’ matters more than ‘when next.’ Reallocating capital into better opportunities is not timing. It is positioning. It is an exercise in judgment, not prediction.

The most obvious place to start looking for structural opportunity is where price action is detached from business reality because of mechanical selling and forced rebalancing. Spinoffs, breakups, and forced sellers create distorted prices. That distortion can last for a long time. Markets tend to treat these events as noise early on. They treat them as fundamentals later.

In a spinoff, price often falls not because the underlying business deteriorates, but because index funds must sell and institutions cannot hold outside their mandates. Liquidity dries up. Traders avoid names that are small or unloved. Meanwhile, the separated business often has clearer strategies, better aligned incentives, and a balance sheet that makes sense on its own. Fundamentals improve while price weakens. That is not a contradiction. It is the structure. That is where averaging down makes sense. You are not buying because the stock is cheap. You are investing due to the strengthening of the business thesis and the price's disconnection from the cash-return profile. Time works for you because patience aligns with structure, not with sentiment.

That does not mean every spinoff works. It does not mean every structural shift creates value. Weak balance sheets, poor management discipline, debt dumps without strategic clarity, and the absence of a competitive moat all ruin otherwise promising setups. Structure is not a guarantee. It is an opportunity. What it means for investors right now is that focusing on timing and trying to predict when the broad market will peak is a distraction. The true concern lies in determining where investors are squandering capital and where they are applying it with discipline. Stocks with rising earnings but poor capital deployment are not safer than stocks with shaky earnings and excellent capital discipline. In many cases, the latter will outperform because capital is directed into higher-return uses.

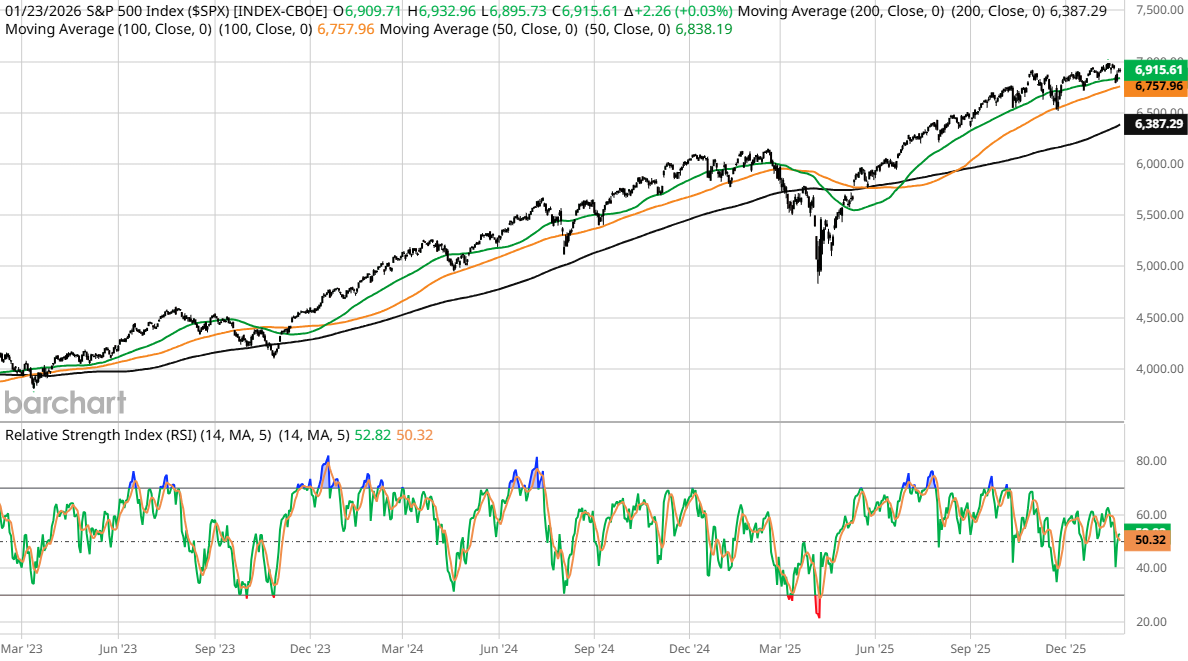

This market is not yet a warning signal. It is a quietly tense one. Price is rising because of mechanical flows, not because fundamentals are uniformly improving. Liquidity still dominates sentiment. When that dynamic changes, price will follow. The point is not to guess when. The point is to be positioned where fundamental cash deployment tells you what will matter when price finally catches up.

Right now, the signal that matters is capital allocation. This is not to say that earnings are irrelevant. They are not. But they are backward-looking. Capital allocation is forward-looking. It tells you what happens next instead of what happened last quarter. Markets do not reward bravado. They reward correct positioning. Read the price, yes. But read capital decisions more closely.

On the date of publication, Jim Osman did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.