Is The Fed Getting Ready To Rip Off The Band-Aid?

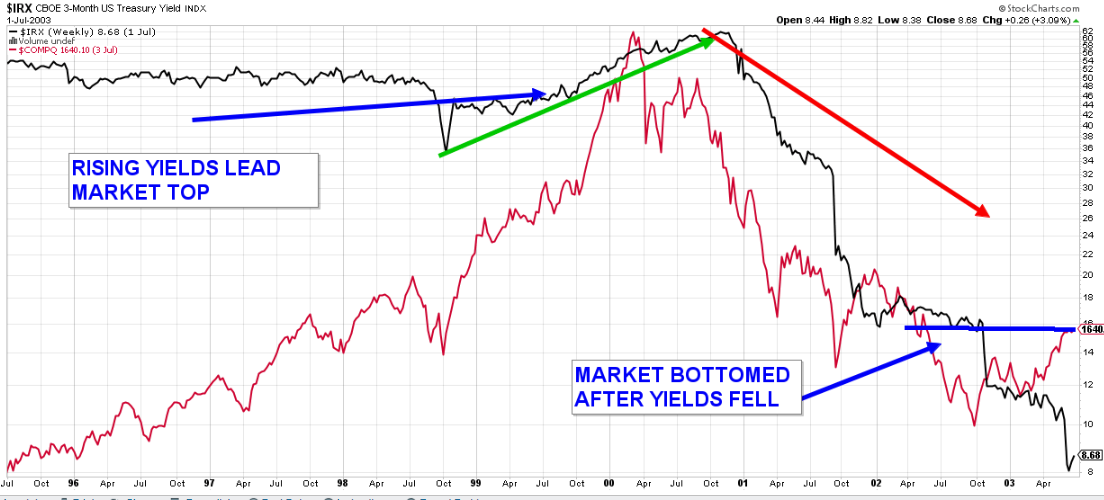

Today, the frictional buzz is now all about inflation and recession. It feels quite strange that the Fed would be raising interest rates as the economy is supposedly racing into the jaws of a recession. As I often like to say, “I hear what you are saying, but what is the money saying?” To this, I simply go to the 10-year Treasury. The rate on the 10-year has been falling consistently from mid-June (when it was over 3.5%) to now, at a low of just under 2.8%. If inflation and overzealous growth were really an issue, the rate on the 10-year would not be falling and the prices of oil and some foodstuffs are supporting this economic slowdown.

I hear the talk about inflation and how it’s a big problem for the stock market. Don’t look now, but the interest rates are singing a different tune. As of last week, the rate of upward EPS estimates revisions for the S&P 500 has been sitting around 37%. This is a pretty important number as it tends to bottom at 10-30% during times of economic slowdown. So, it is looking like we are pretty much there. Investors appear to have been wanting companies to simply rip off the Band-Aid when it comes to lowering 2022 and 2023 earnings guidance and outlooks. But we may be facing a situation in which the Band-Aid is pulled off more slowly and not completely removed until later this year.

With earnings season underway, in addition to following beats, misses, and growth rates as second quarter reports stream in, we are also assessing the potential future path of earnings. That’s super tricky right now given the uncertainty. Some expect steady growth in earnings for the foreseeable future while others are expecting a significant decline into 2023. Given the amount of technology used in all phases of business, along with the supply chain issues that have already been clearly discounted in stock prices, I believe that the revenue environment and corporate productivity are in too good of shape for earnings to contract anytime soon.

History shows that it takes a pretty rough economic environment to knock earnings meaningfully off track. Even during the most recent shock from the virtual shutdown of the world during COVID, earnings dipped 13% before the quick snapback and the markets had already recovered before these earnings snapbacks were even reported. Again, remember, that the market is a discounting mechanism. The pullback we have experienced is not from cracks in the structure but rather a pullback from the quickest doubling of the markets ever seen in history and bleeding off of some of the sugar high from the massive amount of money thrown at our US consumers.

In a bear case scenario, as can be seen above in March 2009 and April 2020, a 10-15% decline in earnings is a reasonable expectation. But our economic forecast still calls for no recession this year and a 50% chance next year. A soft landing will still be very difficult for the Fed to achieve, but it’s possible. And a recession could be very mild, resulting in a smaller hit to earnings.

We have had a -1.9% GDP for the first quarter of this year and we are expecting around -1.5% for the second quarter. This would normally constitute a recession given two back-to-back quarters of negative GDP, but we don’t believe that the slowing we are seeing is due to “normal” economic factors and for that reason, we believe more of a soft-landing would be the more appropriate expectation.

The markets have been in a painful decline for some time now; really since November of last year, so to expect investors to forget about this pain and just go “all in” would be a hard pill to swallow. At this point, the major indexes will need to show that they can correct this bounce move off the lows, come down, not go to lower lows and then rally once more to show that possibly the bear is ready for hibernation. It is too early to tell, but we will be sure to let you know when we see it in our weekly missives. I will leave you with the picture of the “Williams Panic Indicator” which shows that we are at the panic levels we have seen previously- panic levels from which the markets rallied up and out. Again, we won’t know that the panic indicator was accurate until there is more technical data showing that the tide has turned. But for now, earnings are coming in pretty good, and even big-cap technology companies that have preannounced negative expectations are beginning to show resiliency off of their lows.

As always, please feel free to call with any questions you may have. The whole Tower 68 team is here to address any questions or concerns you may have.

.-----------------------------------------------------------------

Source

https://www.tower68.com/blog/is-the-fed-getting-ready-to-rip-off-the-band-aid-1